BLOG

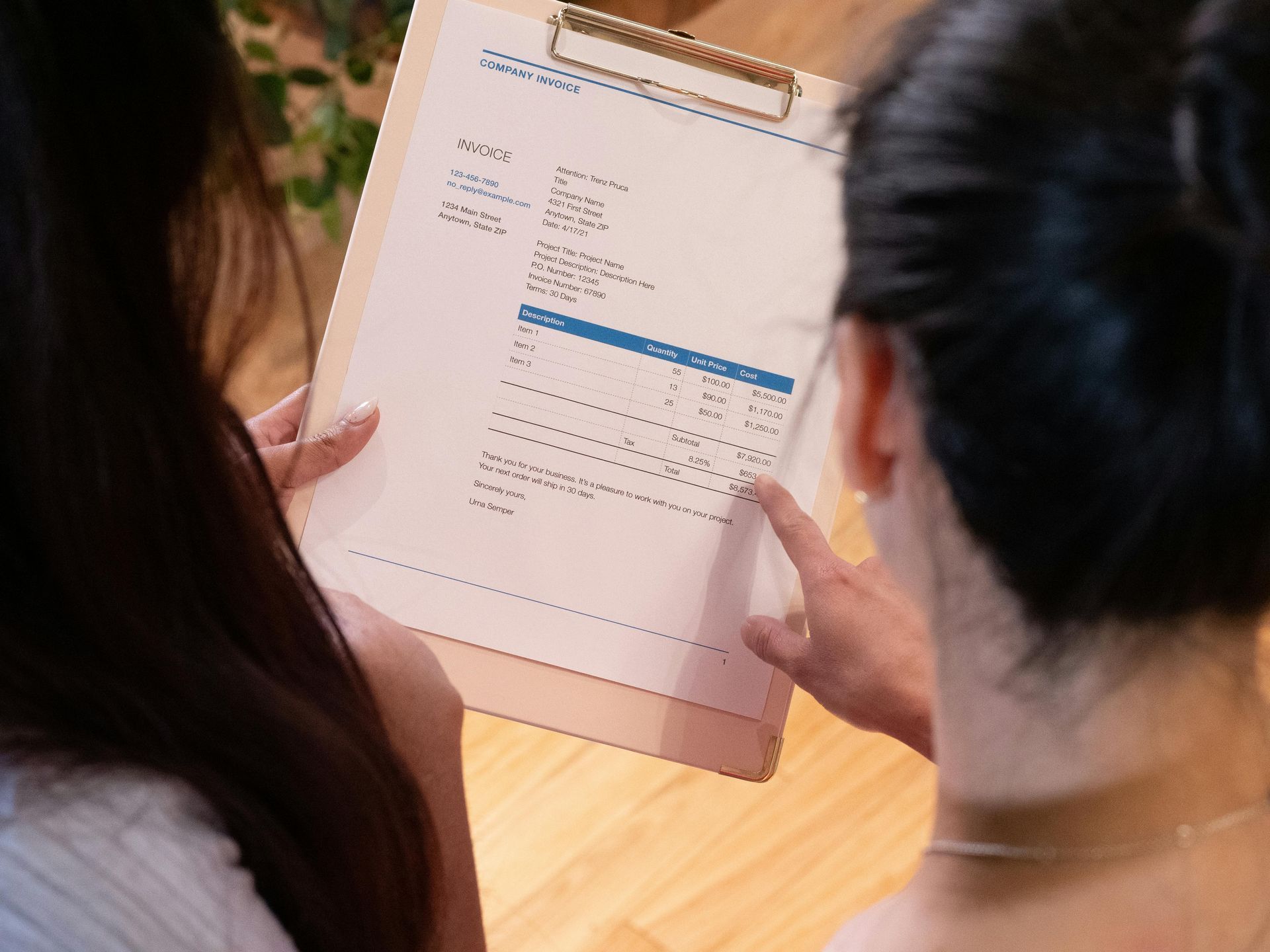

Understanding Invoicing and Accounts Receivable Support: A Must-Have for Small Business Success As a small business owner or freelancer, staying on top of your finances can feel overwhelming. Between client work, marketing, operations, and admin tasks, it’s easy for some things to slip through the cracks, especially your invoicing and accounts receivable (A/R) processes. But did you know that managing these effectively is crucial not just for your cash flow, but for the overall health and growth of your business? Let’s break it down: What Is Invoicing and Accounts Receivable Support? Invoicing and accounts receivable support is the process of managing the financial workflow that ensures your business gets paid. Invoicing refers to creating and sending detailed bills to clients after delivering a product or service. Accounts receivable represents the outstanding payments your business is owed, essentially, the money that’s expected to come in. This support involves setting up and managing your billing systems, tracking which invoices have been paid, and following up with clients who are late. It’s about making sure your payment process is clear, organized, and consistently followed. When managed properly, invoicing and A/R support helps your business: Get paid faster Maintain steady cash flow Avoid payment disputes Save time on admin work Focus more on client service and growth Why Is Invoicing and A/R So Important? For many small businesses and freelancers, cash flow is the lifeblood of daily operations. When clients delay payments or invoices get lost in the shuffle, your cash flow takes a direct hit. And when cash flow suffers, it affects your ability to pay bills, reinvest in your business, and grow. Timely and professional invoicing also shows clients that you run an organized, trustworthy operation. It sets expectations, improves the client experience, and encourages quicker payment. What Are the Consequences of Poor Invoicing and A/R Management? If you don’t have a solid invoicing and A/R process, here are some of the issues you might face: Delayed payments that create cash flow problems Time-consuming follow-ups that take you away from billable work Lost or missed invoices that result in lost revenue Strained client relationships due to unclear payment terms Increased stress and uncertainty about income and financial stability These problems compound over time, turning minor inefficiencies into major business obstacles. How Can a Bookkeeper Help With Invoicing and Accounts Receivable? A professional bookkeeper provides more than just data entry, they bring structure, consistency, and accountability to your invoicing and A/R workflow. Here’s how a bookkeeper can help: Set up and maintain a reliable invoicing system Ensure invoices are created accurately and delivered on time Monitor incoming payments and follow up with overdue clients Create helpful reports (such as aging summaries) to track who owes what and for how long Help you establish consistent payment policies and processes Bookkeepers understand the details of small business finances and can offer insights to help you make better decisions. They ensure your invoicing and A/R process supports, not hinders, your business success. Final Thoughts: A streamlined invoicing and accounts receivable process isn’t just good practice, it’s a smart strategy for sustainable business growth. Managing your invoicing and accounts receivable isn’t just about collecting payments, it’s about creating stability, building trust with your clients, and giving yourself the freedom to focus on what you do best. Whether you're just getting started or looking to tighten up your processes, now is the perfect time to put systems in place that support your long-term success. Business and Notary Solutions, LLC – Helping small business owners take control of their finances, one invoice at a time.